Steps to Import Fixed Assets in ERPNext

By Bright Lartey on February 3, 2026

IntermediateStep 1: Confirm Prerequisites in ERPNext

Before importing any fixed asset, ensure that your ERPNext environment is properly configured.

Verify that the Company is created and active.

Ensure your Chart of Accounts is fully set up, especially:

- Fixed Asset Account

- Accumulated Depreciation Account

- Depreciation Expense Account

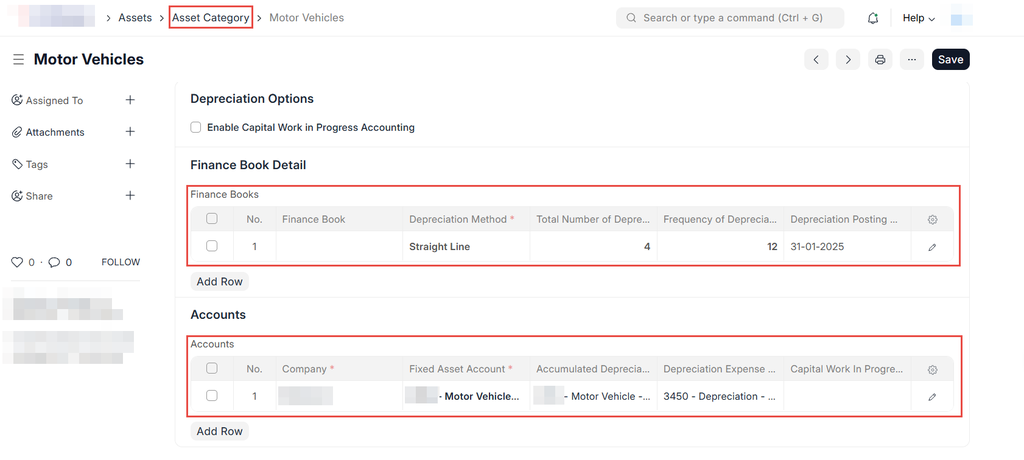

Confirm that Asset Categories are already created with correct depreciation settings, including useful life, depreciation method, and frequency.

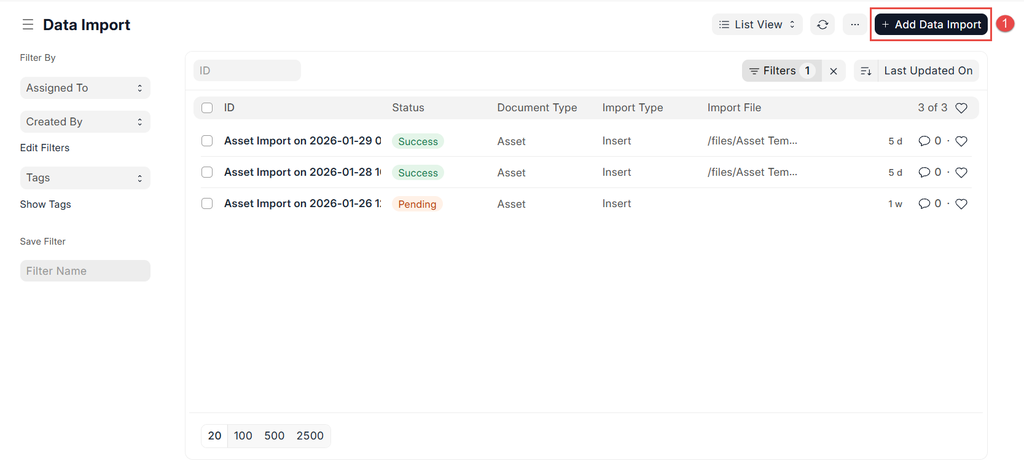

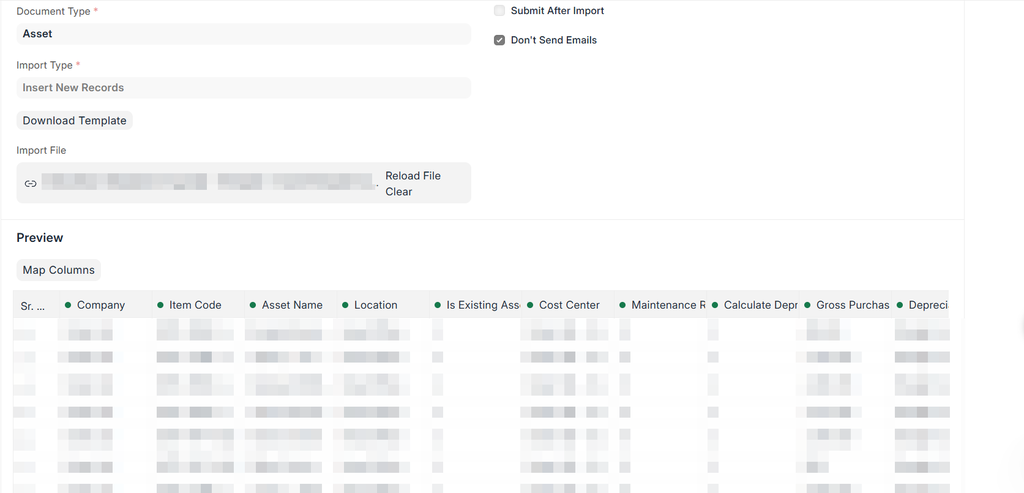

Step 2: Navigate to the Data Import Tool

From the ERPNext Desk, go to:

Settings → Data Import

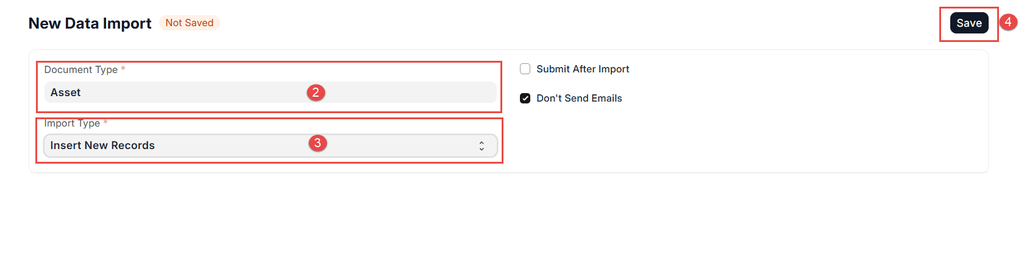

Select Asset as the document type and choose Import Type: Insert New Records.

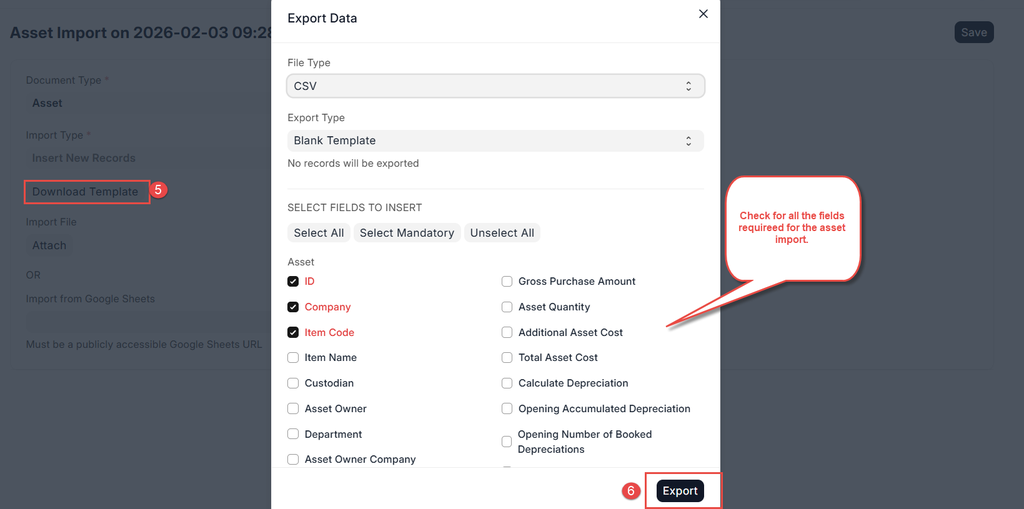

Step 3: Download the Asset Import Template

Click on Download Template to obtain the Excel or CSV file used for importing assets.

Open the template and review the available fields carefully.

Step 4: Fill in the Asset Import Template

Enter asset details in the template. Ensure accuracy for all mandatory fields, including:

- Asset Name

- Company

- Asset Category

- Purchase Date

- Available for Use Date

- Gross Purchase Amount

If the asset already has depreciation recorded outside ERPNext, also fill in:

- Opening Accumulated Depreciation

- Number of Depreciation Periods Booked

Save the completed file in the required format.

Step 5: Upload the Completed Template

Return to the Data Import screen and upload the completed file.

Click Upload to load the data into ERPNext for validation.

📸 Screenshot: Uploading Asset import file in Data Import

Step 6: Validate the Import Data

Click on Attach to allow ERPNext to check the data.

Review any validation errors displayed and correct them in the template if necessary, then re-upload.

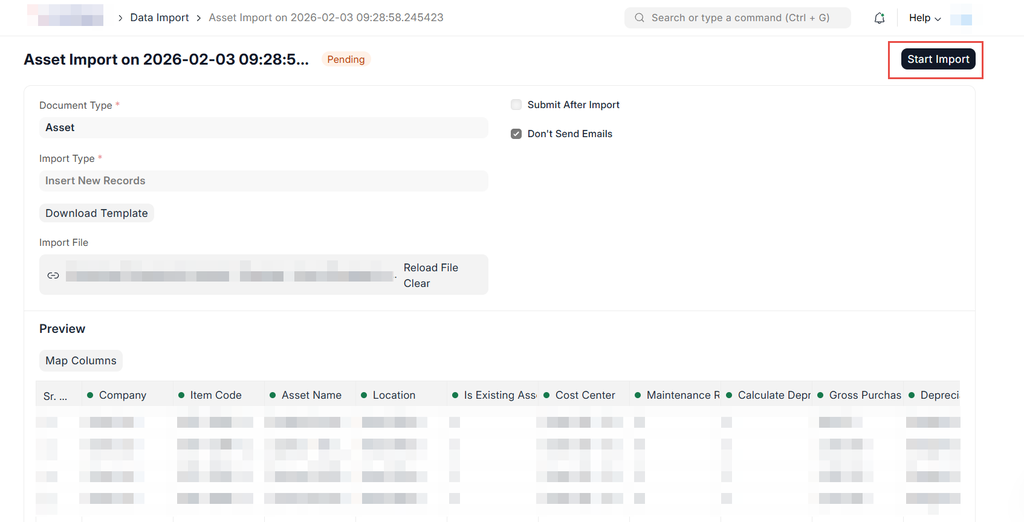

Step 7: Import the Assets

Once validation is successful, click Start Import to complete the import process.

ERPNext will create Asset records based on the uploaded data.

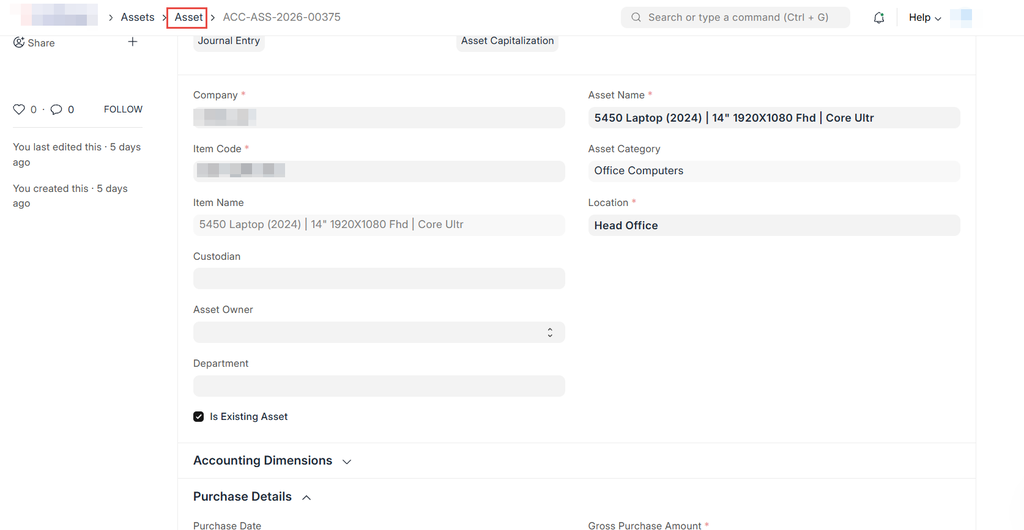

Step 8: Review Imported Assets

Navigate to:

Assets → Asset List

Open a few imported assets to verify:

- Asset value

- Depreciation schedule

- Asset category

- Dates and accounts

Step 9: Submit the Assets

If the assets were imported in draft status, submit each asset after review.

Submitting the asset enables depreciation and accounting entries as configured.

Step 10: Confirm Accounting Impact

Go to the General Ledger and Fixed Asset Register reports to confirm that asset values and depreciation are correctly reflected.

If this is a system migration, ensure totals match the opening balances from the previous system.

More articles on Erpnext